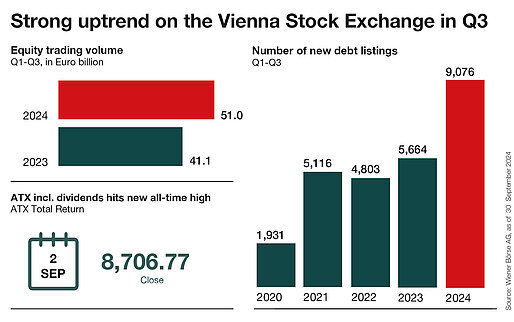

(Vienna) Exceptionally high trading volume, already a further record year for bond listings and a new all-time high for the national benchmark index (including dividends): The Vienna Stock Exchange can look back on a positive third quarter. With equity turnover of EUR 8.1 billion, September was one of the the four busiest months in the past ten years. With around 9,100 listings, the most active bond year to date, 2023, was already surpassed. The ATX Total Return also set new records, reaching its current peak of 8,706.77 points on 2 September 2024. With the expansion of the international "global market" segment investors now have an even broader selection of international stocks at domestic conditions.

"The year to date on the Vienna Stock Exchange has been very positive from both a business and investor perspective – given the performance of the national index. The high equity turnover is largely due to extraordinary movements in the real estate sector. Adjusted for this special effect, there is still potential in terms of turnover, as geopolitical conflicts and the economic situation continue to weigh on the sentiment of international investors," says Christoph Boschan, CEO of the Vienna Stock Exchange.

Extraordinary factors cause equity turnover to surge

Equity turnover on the Vienna Stock Exchange has risen sharply in the last three months. At EUR 8.1 billion (2023: EUR 4.0 billion), September was exceptionally strong in terms of turnover, concluding a very dynamic quarter. Trading volumes in August (EUR 6.7 billion, 2023: EUR 3.4 billion) – the strongest since 2012 – and July (EUR 5.3 billion, 2023: EUR 3.7 billion) were already at an high level. M&A activities in the real estate sector were the main driver of this development. Overall, share turnover after three quarters totalled EUR 51.0 billion (2023 Q1-Q3: EUR 41.1 billion), with an average turnover of EUR 384 million per trading day. The strongest trading days were 20 September (EUR 891.5 million), followed by 6 September (EUR 534.7 million) and 11 September (EUR 474.2 million). The most traded Austrian stocks as of 30 September were Erste Group Bank AG (EUR 7.9 bn), CA Immobilien Anlagen AG (EUR 6.5 bn) and OMV AG (EUR 6.2 bn).

Bonds: Record year 2023 already exceeded

The number of debt listings on the Vienna Stock Exchange continues to grow unabated. So far in 2024, 9,076 new bonds have been listed, more than ever before in a single year. The Vienna Stock Exchange is thus consolidating its position as one of the most active debt listing venues in Europe and currently serves over 1,000 issuers from 38 countries with a total volume of around EUR 800 billion. The Vienna ESG Segment for green bonds is also growing steadily. Most recently, voestalpine AG was the first European steel company to issue a green corporate bond (issue volume: EUR 500 million). The ESG segment now comprises more than 120 listings with a total volume of around EUR 29 billion.

global market: Steadily growing range of international equities

Following the latest global market expansion, investors can now trade 30 additional international equities from the USA, Germany, France, Italy, the Netherlands and Luxembourg at domestic fees, in euro and during Vienna Stock Exchange trading hours. The global market segment now includes over 800 securities from 27 countries. The Springer Nature stock will also be tradable in the international segment of the Vienna Stock Exchange after the planned IPO this Friday.

New all-time high: record level for ATX including dividends

The Austrian Traded Index (ATX) including dividends continues to reach record levels, extending its series of new all-time highs in the third quarter – most recently on 2 September (8,706.77 points). Since the beginning of the year, the ATX TR has risen by 11.85% (ATX excluding dividends: 6.41%). S IMMO AG (+76.80%), BAWAG Group AG (+44.96%) and Erste Group Bank AG (+34.09%) were the strongest performers in the prime market so far this year. The market capitalisation of all companies listed in Vienna amounted to EUR 129.2 billion at the end of September.

In view of the recent parliamentary elections, Boschan reiterates his appeal to politicians: "We hope that the future government will take greater account of the capital market in solving the many challenges – from financing social security systems to transforming the economy – and recognise its importance for the national economy. Many social tasks cannot be meaningfully tackled without a strong capital market. The reintroduction of a retention period for securities to reduce the tax burden on long-term investments would be an important step towards strenghtening the capital market."

About the Vienna Stock Exchange

As the central infrastructure provider in the region, Wiener Börse AG opens doors to global markets. It unites the stock exchanges in Vienna and Prague. Listed companies benefit from maximum liquidity there, and as the market leader it offers investors fast and inexpensive trading. Wiener Börse collects and distributes price data and calculates the most important indices for a dozen markets in the region. Thanks to its unique know-how, the national exchanges in Budapest, Ljubljana and Zagreb also rely on the IT services of the Vienna Stock Exchange. In addition, it is involved in other energy exchanges and clearing houses in the region.

Disclaimer

This press release may contain certain forward-looking statements and projections based on assumptions current at the date of this press release. We assume no liability whatsoever that these forward-looking statements will occur. Furthermore, we expressly point out that this press release does not serve as a basis for an investment decision and constitutes neither an invitation to buy nor an investment recommendation by Wiener Börse AG. The information in this press release is provided without guarantee.