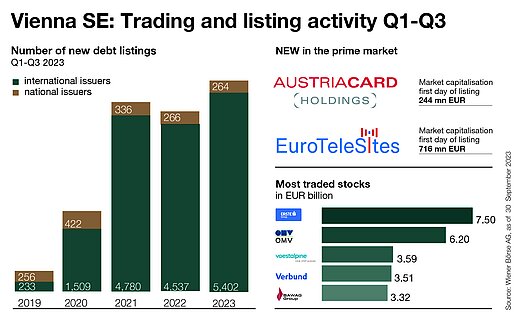

(Vienna) In the first three quarters of the year, the Vienna Stock Exchange continued to record strong growth in the bond segment, with around 2,300 new listings in the last three months alone. Regarding equities, the listing of EuroTeleSites AG was the second new entry to the top-segment prime market of the Vienna Stock Exchange this year, following the listing of AUSTRIACARD HOLDINGS AG in the spring. All this in a challenging economic environment: high interest rates, inflation and geopolitical tensions continue to weigh on investor sentiment and thus on trading volumes.

"Investors are exercising restraint due to the challenging economic conditions, and thus trading activity on the European capital markets is moderate. Nevertheless, we were recently able to welcome the second successful listing in the top segment this year with EuroTeleSites – after AUSTRIACARD HOLDINGS in the spring", summarises stock exchange CEO Christoph Boschan and adds: "The interest in corporate financing via the stock exchange is high, which we also notice in the interest in our IPO workshops.”

Sustainable bonds and Vienna MTF on the rise

In the bond segment, two thresholds were exceeded. The Vienna MTF grew significantly with around 2,300 new listings in the past three months, bringing the total number of bonds listed on the Vienna Stock Exchange to over 15,400. This means that the Vienna MTF remains the number one exchange-regulated segment in Europe. The total volume of bonds listed on the Vienna Stock Exchange is around EUR 740 billion, issued by around 880 active issuers from 38 countries.

A milestone was also reached in sustainable bonds: The listings in the Vienna ESG Segment surpassed the number of 100 for the first time. This means that the contingent of sustainable bonds aligned with international standards on the Vienna Stock Exchange has almost doubled since 2022 (01/01/2022: 53 ESG bonds). Issuers in the Vienna ESG segment have already raised a total of more than EUR 20 billion in financing that flows into the sustainable transformation.

Low volatility impacts equity turnover

After three years of exceptional trading activity – caused by the COVID 19 pandemic and the Russian war of aggression – the overall market has moved sideways in 2023 due to the difficult economic environment. After the first three quarters, equity turnover amounts to EUR 41.07 billion, which corresponds to a monthly average of EUR 4.56 billion. The strongest trading days in the third quarter were 15 September (EUR 618 million) and 31 August (EUR 288 million). The majority of turnover (86%) was generated by international trading participants. The Austrian shares with the highest turnover during the year were Erste Group Bank AG (EUR 7.5 billion), OMV AG (EUR 6.2 billion) and voestalpine AG (EUR 3.6 billion). With a price increase of 58.18%, Immofinanz AG share was the top performer since the beginning of the year, followed by EVN AG (49.7%) and Flughafen Wien AG (47.6%).

ATX Total Return increases by 6.2 percent year-to-date

In the course of the year, the ATX TR (incl. dividends) gained 6.2% and closed at 7,006.02 points on 29 September 2023 (ATX without dividends +1.34%, 3,168.13 points). When comparing with other country indices, the ATX composition with its focus on banks and commodities must be taken into account. The market capitalisation of all companies listed in Vienna amounted to EUR 119.19 billion by end of September.

Vienna Stock Exchange supports "Finanzbildungsstrategie"

Within the framework of the national “Finanzbildungsstrategie”, another important step was taken this school year. From now on, financial and economic education will be given greater weight in the curricula of the 5th to 8th grade. The Vienna Stock Exchange supports this with the appropriate teaching materials "börse4beginners", which deal with different ways of investing money, the functioning of markets and the services and products of listed companies that are encountered every day. At the “Wiener Börse Akademie”, the range of courses for advanced students has also been expanded: in 2024, seminars on the topics of Exchange Traded Funds (ETFs), Growth Investing and the Private Investor course will be added to the programme.

"Financial education remains a crucial lever to strengthen the domestic capital market. The financial education strategy is an important step in the right direction. Conveying a sensible risk-reward assessment and enabling people to have a self-determined financial future accordingly must be a basic requirement and therefore permanently high on the political agenda," says CEO Christoph Boschan.

About Wiener Börse AG

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Uniting the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.