- Equity turnover increases by more than a third in Q1

- Twice as many bond listings as in the previous year

- Dividend debate: Call for leaving the decision to the companies

- Now more than ever, investors should think long-term

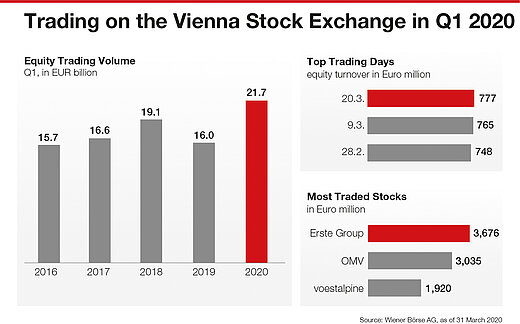

(Vienna) In the first quarter the coronavirus causes turbulence on the global stock markets. The Vienna Stock Exchange records strong price fluctuations and trading volumes. Equity turnover in the first quarter amounts to EUR 21.7 bn, an increase of 35.63% versus the previous year (Q1 2019: EUR 16 bn). Especially in turbulent times, it is essential that stock exchanges remain open. Vienna Stock Exchange ensures business continuity in times of crisis and operates its electronic trading venue via remote access and telecommuting.

"When deciding for a temporary short selling regulation, the FMA took the right step for our national market. Closing stock exchanges would be like throwing away the clinical thermometer when high temperatures set in. The stock markets may be turbulent, but the strength of the Austrian listed companies does not disappear overnight, the senior executives are as convinced of this as I am," says Christoph Boschan, CEO of the Vienna Stock Exchange. In a letter to investors, more than 80 Austrian top managers demonstrate solidarity and remind investors of their strengths, their stable planning and dividend policy, their excellent crisis management as well as their international market opportunities and research activities.

Protective mechanisms provide stability in extreme market situations

The Vienna Stock Exchange uses protective mechanisms that have been tried and tested for decades. Circuit breakers ensure smooth trading even in extreme market situations. At EUR 7.2 billion, the average monthly turnover in 2020 is at its highest level in over 10 years. In March EUR 10.94 bn were traded, an increase of 82.64% versus March 2019 (EUR 5.99 bn). The most active trading days in 2020 were the Triple Witching Day on 20 March with EUR 777 m, followed by 9 March (EUR 765 m) and 28 February (EUR 748 m). The most actively traded Austrian stocks were Erste Group Bank AG with EUR 3.68 bn, ahead of OMV AG with EUR 3.04 bn and voestalpine AG with EUR 1.92 bn. Raiffeisen Bank International AG (EUR 1.79 bn) and Verbund AG (EUR 1.45 bn) follow in fourth and fifth place.

Bond listings reach new high

In Q1 2020, the Vienna Stock Exchange saw two capital increases on the regulated market (S Immo AG and Cleen Energy AG) and two listing extensions in the entry segment (NET Energy Technologies AG and Eyemaxx Real Estate AG) with a total volume of more than EUR 150 m. On debt side, Vienna Stock Exchange attracted 313 new bond listings, twice as many as in the previous year. With 229 new bonds, a large part came from international companies. These include BBVA, the second largest bank in Spain and one of the 50 largest banks worldwide. Since March, it has listed the majority of its new bonds on the Vienna Stock Exchange.

More than ever: A long-term and diversified strategy counts

Stock prices worldwide are suffering from the coronavirus. The domestic ATX fell by 37.19% in the course of 2020. Semperit AG is the only prime market company recording a plus (5.03%). The market capitalization of the companies listed on the Vienna Stock Exchange decreases to EUR 78.21 bn as of 31 March 2020. The market value of the Austrian companies thus roughly corresponds to the level at the time of the brexit referendum in Great Britain in June 2016.

"Stock prices react sensitively to changes in economic and corporate forecasts. However, the leading Austrian index ATX has still shown an average annual return of five percent, despite all the crises and distortions since it’s start in 1991. Investors can minimize the risk of equity investments by making long-term, regular and broadly diversified investments," says CEO Christoph Boschan.

Dividends: Decision by company on a case-by-case basis

With regard to dividend payments, a local discussion flared up if payments should be made in times of crisis. Investors profit from good times – as last year through dividends – and bear the consequences of bad times – as the current price drops and volatility. The discussed dividends will be paid out for the business year 2019, if the situation of the individual company allows it. The Vienna Stock Exchange is convinced that companies, in close cooperation with all stakeholders, know best whether and which dividend payment remains possible.

"So far it is clear how diligently the companies are acting and that there is no reason for government bans. Company law obliges – rightly so – to take the current economic situation into account anyway when deciding on dividends. Together with the employees, the local companies and their investors will have a decisive influence on whether and how quickly Austria can be successfully reconstructed after the crisis. The international investors, who make up about half of the investors on the Vienna Stock Exchange, will be of crucial importance in this context", says Christoph Boschan.

About the Vienna Stock Exchange

Wiener Börse AG operates the stock markets in Vienna and Prague. The group provides state-of-the-art systems, information and IT-services. It offers investors fast and cost-effective trading as well as the highest level of transparency. Domestic listed companies enjoy the most liquidity and maximum visibility on their national stock exchanges. Wiener Börse operates the market data hub for Central and Eastern European markets and has established itself in the calculation of indices for the region. It cooperates with over ten exchanges in CEE and is valued worldwide for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.