(Vienna) The Vienna Stock Exchange looks back on an upward trend in the first half of 2024 The performance of the ATX Total Return has picked up strongly in the first six months: The national benchmark index including dividends hit a new all-time high and remains close to its peak. Equity turnover is rising again in Vienna, even though trading activity remains subdued across Europe. The Vienna Stock Exchange remains in a special position in terms of bond listings, where the historically strongest first half year ever was recorded. The listing of MWB AG marked a recent addition to the SME segment direct market plus. Another international trading member, Jump Trading Europe B.V., was connected to trading in Vienna.

ATX including dividends ranks at record level

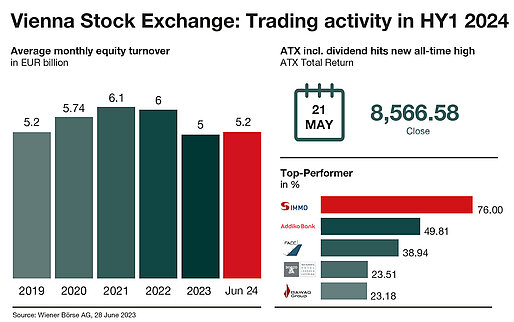

The leading national index performed very well in the first half of the year. The ATX Total Return (including dividends) gained 10.17% year-on-year (as of 28 June 2024, ATX excluding dividends: 5.08%) and has already set several new records in 2024, surpassing the previous high of 9 February 2022 (8,251.98 points). The most recent all-time high was reached on 21 May at 8,566.58 points. With its performance, the ATX TR outperformed the German DAX (+8.86%), which also includes dividends. S IMMO AG (+76.00%), Addiko Bank AG (+49.81%) and FACC AG (+38.94%) achieved the strongest performance in the ATX Prime in the first half of the year. The market capitalization of all companies listed in Vienna amounted to EUR 130.21 billion at the end of June.

"Dividends must always be taken into account to get a complete picture of an investment's return. In this regard, the Austrian market has performed well despite ongoing economic uncertainties and is on a new record level. The average dividend yield in Austria is 5.7%. This underlines the resilience and dividend strength of Austria's leading companies, which traditionally pay out high dividends and are therefore very attractive to international investors," says Christoph Boschan, CEO of the Vienna Stock Exchange.

Historically best first half-year for bond listings

Bond listings in the Vienna MTF continue to grow. By 28 June, 6,116 new bonds had been listed in Vienna, more than ever before in the first half of a year. The Vienna Stock Exchange thus confirms its position as one of Europe's most active bond listing venues and currently serves over 1,000 active bond issuers from 39 countries with a total volume of around EUR 800 billion.

The Vienna Stock Exchange continues to score with issuers focusing on ESG: in the first half year, UniCredit Bank Austria AG with EUR 750 million and the domestic utility VERBUND AG with EUR 500 million have successfully issued green bonds. These are included in the Vienna ESG Segment, which is specifically designed for sustainable bonds and has already seen more than 100 listings with a volume of around EUR 27.5 billion. This once again demonstrates the high importance of the capital market for the green transformation of the economy.

A significant change was made to the trading procedure for Austrian government bonds: Since March, these are tradable all-day on the Vienna Stock Exchange. Private investors in particular benefit from the continuous liquidity and high price quality ensured by the market makers Erste Group and Raiffeisen Bank International.

Equity turnover on the rebound

Trading activity and trading volumes were at a subdued level in the first half year – as on most European trading venues. In the second quarter, equity turnover increased again compared to the previous year, reaching EUR 5.21 billion in April (2023: EUR 3.83 billion), EUR 5.10 billion in May (2023: EUR 4.52 billion) and EUR 6.37 billion in June (2023: EUR 4.55 billion). The average monthly equity turnover amounted to EUR 5.16 billion in the first half of the year (2023: EUR 5.00 billion). The strongest trading days in the first two quarters were 15 March (EUR 813 million), 31 May (EUR 553 million) and 21 June (EUR 802 million). The most actively traded Austrian stocks as of 28 June were Erste Group Bank AG (EUR 5.1 billion), OMV AG (EUR 4.4 billion), VERBUND AG (EUR 2.8 billion), Wienerberger AG (EUR 2.7 billion) and CA Immobilien Anlagen AG (EUR 2.4 billion).

"In order to sustainably increase the liquidity of European capital markets, we need the political will to create substantial capital pools. For instance, pension funds should invest more in listed companies. Capital market-oriented pension provision is a very effective approach, as several European countries have shown. Austria should also take this step," demands Christoph Boschan.

About the Vienna Stock Exchange

As the central infrastructure provider in the region, Wiener Börse AG opens doors to global markets. It unites the stock exchanges in Vienna and Prague. Listed companies benefit from maximum liquidity there, and as the market leader it offers investors fast and inexpensive trading. Wiener Börse collects and distributes price data and calculates the most important indices for a dozen markets in the region. Thanks to its unique know-how, the national exchanges in Budapest, Ljubljana and Zagreb also rely on the IT services of the Vienna Stock Exchange. In addition, it is involved in other energy exchanges and clearing houses in the region.

Disclaimer

This press release may contain certain forward-looking statements and projections based on assumptions current at the date of this press release. We assume no liability whatsoever that these forward-looking statements will occur. Furthermore, we expressly point out that this press release does not serve as a basis for an investment decision and constitutes neither an invitation to buy nor an investment recommendation by Wiener Börse AG. The information in this press release is provided without guarantee.