(Vienna) The strong trading activity on the Vienna Stock Exchange continued in the first half of 2022. The Russia-Ukraine war, geopolitical uncertainty as well as the central banks' interest rate decisions caused turbulence on the stock markets. The total equity turnover on the Vienna Stock Exchange (EUR 42.79 billion) was up 10% on the previous year. Vienna's listing venue is winning over more and more international debt issuers despite the subdued issuing environment. The number of bonds listed exceeded 12,300 for the first time. With the Vienna ESG Segment, international standards for sustainable bonds provide more transparency.

"We are in a phase of transformation. Climate change and the ageing society call for innovation, and European visionaries are looking for capital. Public markets need to be strengthened for European innovations to thrive on the global stage. Private capital should be activated to achieve this goal,” says Christoph Boschan, CEO of Wiener Börse AG. "As a company, the Vienna Stock Exchange is constantly innovating and preparing for the future. As a national stock exchange, we are the ideal platform to connect Austrian with international market participants."

Equity turnover at 10-year high in first half of 2022

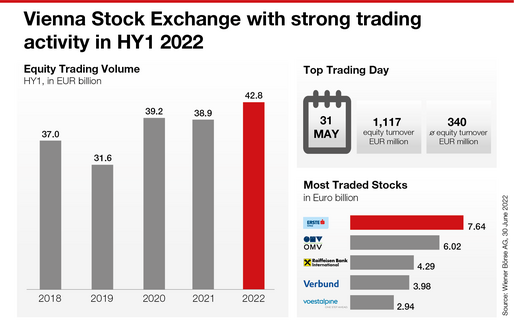

In the first half of 2022, the Vienna Stock Exchange recorded a total turnover of EUR 42.79 billion on 126 trading days (HY1 2021: EUR 38.90 billion, + 10 %). 80% originated from international trading participants. After a very strong first quarter, trading activity also remained high in the second quarter. On an average trading day, EUR 340 million were traded. 31 May (EUR 1.12 billion), 28 February (EUR 911 million) and 18 March (EUR 870 million) were the most active trading days. To sustainably strengthen the trading quality in Vienna, the Vienna Stock Exchange introduced the "Best Bid and Offer" liquidity model in the prime market, thus aligning itself with international standards.

The most active stocks in the first half of the year were Erste Group Bank AG (EUR 7.64 billion), OMV AG (EUR 6.02 billion), Raiffeisen Bank International AG (EUR 4.29 billion), Verbund AG (EUR 3.98 billion) and voestalpine AG (EUR 2.94 billion).

Vienna MTF becomes prime venue for debt listings

With 3,578 mostly international new listings, Vienna remains one of the most sought-after bond listing venues in Europe in HY1 2022. The increase of 11% compared to the previous year comes from international clients; new listings include, for example, the Development Bank of Kazakhstan, the Polish mBank SA or Europcar UK. With this development, the Vienna Stock Exchange is defying the very subdued issuing environment, which has been considerably burdened by the war since February. The Vienna ESG segment for bonds creates more transparency following international standards. The Austrian green government bond was one of the first newcomers in this segment in May.

Keeping an eye on index composition for short-term comparisons

In the first half of the year, stock prices fell on all developed stock markets. After the Austrian benchmark index ATX gained 43.59 % including dividends in 2021, it lost 22.88 % year-to-date. On 30 June 2022, the ATX TR (including dividends) closed at 6,053.33 points (ATX without dividends -25.43%, 2,879.29 points). The top gainers on the prime market year-to-date were Schoeller-Bleckmann Oilfield Equipment AG (+73.51%), Flughafen Wien AG (+23.12%), AT&S Austria Technologie & Systemtechnik AG (+17.78%), Frequentis AG (+13.48%) and STRABAG SE (+10.64%). The ATX composition is very cyclical, with heavyweights in the financial sector. As a result, the national index bounces more strongly in both directions during volatile market phases. The average return over the long term is in line with the European average of 6-7 %. The market capitalisation of companies listed on the Vienna Stock Exchange amounts to EUR 113.40 billion.

"Austrian listed companies excel with high management quality, stable business models and, at the same time, strong research and development spending on innovation projects, which secure their market position and dividends for the future. Austrian stocks belong into any well-balanced European portfolio. Retail investors would do well to shift their focus away from day-to-day events and towards long-term market and company performance. This is not only a better way to sleep, it is the only way to benefit from long-term real returns above inflation," says Christoph Boschan.

Download infographics:

Trading on the Vienna Stock Exchange in HY1 2022 (png-file 150 KB)

Record number of debt listings (png-file 80 KB)

About the Vienna Stock Exchange

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.