(Vienna) After a subdued previous year, equity turnover on the Vienna Stock Exchange rose noticeably in 2024. The Austrian benchmark index including dividends reached a new all-time high. Measured by the number of new debt listings, the record year 2023 was once again clearly surpassed. With MWB AG, ReGuest S.p.A. and UKO Microshops AG, the Vienna Stock Exchange recorded three new additions to the SME segment direct market plus. The Vienna Stock Exchange recently expanded the functionality of its trading system with the introduction of midpoint trading.

"With the implementation of midpoint trading and the all-day tradability of Austrian government bonds – to name just two topics – we as an infrastructure company have realised important strategic initiatives in the interests of the market participants. The state-of-the-art infrastructure is constantly being adapted to current needs. However, the extent to which it is utilised, in other words how many trains and what loads run on the tracks, depends largely on the political framework conditions," says Christoph Boschan, CEO of the Vienna Stock Exchange, emphasising the need to strengthen the domestic capital market.

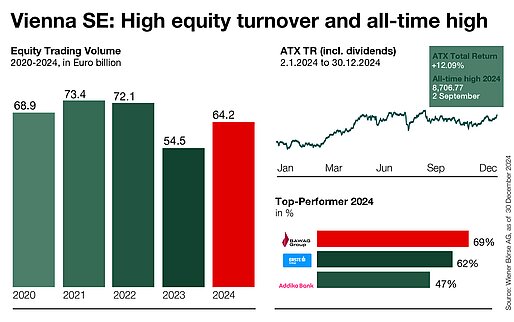

Equity turnover back at a high level after a breather

For 2024, equity turnover will amount to EUR 64 billion, which means an increase of over 17 % compared to 2023 (EUR 54.48 billion). This development was primarily driven by exceptionally high turnover in the real estate sector in the months from June to September. At EUR 8.1 billion, September was one of the four months with the highest turnover in the last ten years. The three strongest trading days in 2024 were 20 September (EUR 891.5 million), 15 March (EUR 812.8 million) and 21 June (EUR 802.0 million). As of 20 December, the shares with the highest turnover were Erste Group Bank AG (EUR 11.03 billion), OMV AG (EUR 7.66 billion) and CA Immobilien AG (EUR 6.85 billion). Trading in Austrian equities was recently enhanced by a new functionality: The Xetra® T7 trading system now enables midpoint trading. This allows domestic shares to be traded in a separate midpoint order book at a mid-price between the best buy and sell limit.

Debt listings: Record year 2023 clearly exceeded once again

The Vienna Stock Exchange remains one of the most active listing venues in Europe in terms of new debt listings. In 2024, a total of over 13,400 bonds were listed in Vienna, more than 4,000 more than in the previous record year of 2023 (8,311). Prominent listings included the first green bond from a European steel company, issued by voestalpine AG (issue volume EUR 500 million). However, a number of international issuers also rely on the Vienna Stock Exchange as a debt listing venue. The Mongolian capital Ulaanbaatar, for example, placed a state-guaranteed bond (USD 500 million) on the market in Vienna. In total, the Vienna Stock Exchange serves 1,100 active bond issuers from 39 countries. There was an innovation for Austrian government bonds in 2024: since March, they have been tradable in continuous auctions, allowing private investors in particular to benefit from increased price quality and transparency.

ATX Total Return records all-time high

By 20 December, the ATX Total Return had increased by 9.84% to 8,365.71 points (ATX without dividends: 3,589.54 points; 4.50 %), BAWAG Group AG (65.69%), Erste Group Bank AG (60.31%) and Addiko Bank AG (41.57%) were the top performers in the ATX Prime. The market capitalisation of all companies listed in Vienna was around EUR 124 billion at that time.

"Austrians are still being penalised when it comes to private pension provision. The reintroduction of the retention period for securities and the introduction of a retirement savings account were already on the agenda of the last government. Austria was actually further ahead in this respect years ago than Germany, for example, where a subsidised and tax-privileged retirement savings account is now to be introduced. The capital market offers many solutions to the challenges of our time. Now is the time to act boldly and create the basis for a competitive, innovative and prosperous future," says Boschan. In a recently published open letter, the CEO of the stock exchange and Chairman of the Supervisory Board Heimo Scheuch outline blueprints for strengthening the capital market.

The last trading day of the Vienna Stock Exchange will take place on Monday, 30 December 2024, and will end with an early closing auction at 2:15 pm. The stock exchange year 2024 comprised 254 trading days, in the coming year trading will take place in Vienna on 253 days. The trading calendar is available online.

About the Vienna Stock Exchange

As the central infrastructure provider in the region, Wiener Börse AG opens doors to global markets. It unites the stock exchanges in Vienna and Prague. Listed companies benefit from maximum liquidity there, and as the market leader it offers investors fast and inexpensive trading. Wiener Börse collects and distributes price data and calculates the most important indices for a dozen markets in the region. Thanks to its unique know-how, the national exchanges in Budapest, Ljubljana and Zagreb also rely on the IT services of the Vienna Stock Exchange. In addition, it is involved in other energy exchanges and clearing houses in the region.

Disclaimer

This press release may contain certain forward-looking statements and projections based on assumptions current at the date of this press release. We assume no liability whatsoever that these forward-looking statements will occur. Furthermore, we expressly point out that this press release does not serve as a basis for an investment decision and constitutes neither an invitation to buy nor an investment recommendation by Wiener Börse AG. The information in this press release is provided without guarantee.