- Equity turnover in November +27.9% yoy

- Bond listing record: Vienna Stock Exchange fastest growing bond listing venue in Europe

- Last trading day in 2020: 30 December, early closing auction at 2.15 pm

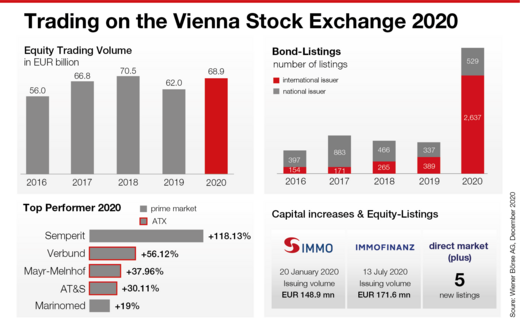

(Vienna) The COVID 19 pandemic and measures to contain the virus caused high volatility on the stock markets in 2020. The Vienna Stock Exchange saw five debuts in its entry segment direct market (plus): Aventa AG (direct market plus), Biogena Group Invest AG (direct market, dm), SunMirror AG (dm), CAG International AG (dm) and Creactives Group S.p.A. (dm). Two companies raised fresh equity in a capital increase: Immofinanz AG (EUR 171.6 m) and S Immo AG (EUR 148.9 m). Regarding debt listings, the Vienna Stock Exchange is heading for another record year. 3,000 new bonds make Vienna the fastest growing listing venue for bond issuers in Europe.

"Despite a challenging environment, we succeeded in implementing a large number of initiatives in 2020. The data business was expanded and we benefited from a strong securities depository in Prague," says Christoph Boschan, CEO of Wiener Börse AG. In 2020, the IT partnerships with the Ljubljana and Zagreb stock exchanges were prolonged. Two new market participants, BRK Financial Group and XTX Markets, extended the list of global trading members to 86. With “Trade at Close”, a new feature was implemented in the trading system. "Next year we will celebrate the 250 year anniversary of the Vienna Stock Exchange. In our anniversary year, we will continue to pursue our strategic initiatives and ensure that the Austrian market continues to receive the international attention it deserves," Boschan adds.

In 2020, the group structure was made more efficient. Wiener Börse AG is now the parent company for both the Vienna and Prague stock exchange. The group's equity turnover amounted to EUR 75.59 bn as of 15 December 2020 (+11% compared to 2019: EUR 68.10 bn). The market capitalisation of both marketplaces totalled EUR 125.02 bn as of 15 December.

Strong trading in a challenging environment

On the Vienna market, equity turnover amounted to EUR 66.43 bn as of 15 December. That’s a plus of 10.9% year-on-year (EUR 59.90 bn). In addition to market fluctuations, significant turnover contributions came from new strategic initiatives. In the <link 8160 - internal-link "Opens internal link in current window">global market</link>, trading volume almost doubled in 2020 (2020: EUR 3.45 bn, 2019: EUR 1.76 bn). Trading on four Austrian public holidays generated additional turnover of EUR 820 m. The most active trading days in 2020 were the Triple Witching Day on 19 June (EUR 915 m), 30 November (EUR 822 m) and the Triple Witching Day on 20 March (EUR 777 m). With the Triple Witching Day on 18 December, one of the strongest trading days is still to come. The most actively traded Austrian stocks in 2020 were Erste Group Bank AG with EUR 11.56 bn, ahead of OMV AG with EUR 8.98 bn and Raiffeisen Bank International AG with EUR 5.27 bn. voestalpine AG (EUR 5.25 bn) and Andritz AG (EUR 4.91 bn) ranked fourth and fifth respectively.

In 2021, the infrastructure of Vienna Stock Exchange - from trading to settlement - will be available on five Austrian holidays. The trading year 2020 will end on 30 December with an early closing auction at 2.15 pm.

Stocks as liquid tangible assets

Due to its cyclical composition, the Austrian national index ATX suffered more than other national indices in 2020. Analysts are convinced that in phases of economic upswing this circumstance turns into an advantage. In November, the vaccine news was promptly followed by a record ATX rally (+24%), which partially compensated the setbacks of the first quarter. Including dividends, the ATX stood at -13.43% (5,303.93 points) as of 15 December, excluding dividends -15.35% (2,697.87 points). Semperit AG was the best performing stock on the prime market since the beginning of the year with a price gain of 119.93%, followed by Verbund AG (39.58%), Mayr-Melnhof Karton AG (34.11%), Marinomed Biotech AG (20%) and voestalpine AG (15.53%). The market capitalisation of all domestic companies listed on the Vienna Stock Exchange amounted to EUR 104.71 bn as of 15 December.

"New Year's resolutions about money are very popular every year. Due to the crisis, this year even more people desire to acquire new skills to become an investor, as the record registrations for our seminars prove. Without financial education, Austrian investors are tied to the widespread low-interest products for the rest of their lifes. Stocks, like other tangible assets, benefit from low interest rates and can be traded transparently at any time. With diversification and a long-term investment horizon, the risk is lower than generally perceived," says Christoph Boschan, CEO of Wiener Börse AG.

Download infographics

Online review of highlights & initiatives

About Wiener Börse AG

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.