- VSE maintained market leadership in equity trading and, expanded its trader member network

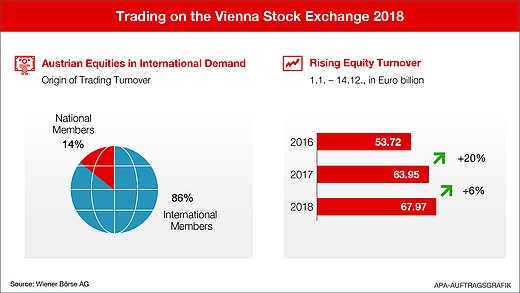

- Trading turnover increased by EUR 4bn to around EUR 70bn, up 6% yoy

- Investors from the US, Austria, UK, Norway and France account for 86% of the turnover

- Outlook 2019: Easy stock market entry for domestic SMEs and young companies

(Vienna) The Vienna Stock Exchange’s annual review shows it has remained the clear market leader in equity trading, while also posting an increase of EUR 4bn (+6% yoy) in trading volume, despite the difficult market conditions marked by heavy regulatory burdens.

"In 2018, the Vienna Stock Exchange reasserted itself on the European and global stage as a hub offering optimal trading quality and an international network. Among European stock exchanges, we rank eleventh in the turnover ranking year-on-year and tenth in November," says Christoph Boschan, CEO of Vienna Stock Exchange and its holding company. "We thus offer leading domestic companies the best platform to reach international investors. In turn, Austrian investors can access international blue chips as well as domestic industry leaders. This combination works well, and the rising turnover in a challenging market environment stands proof of that."

Investors from the US, Austria, UK, Norway and France account for most of the turnover

Share turnover increased in the course of the year to EUR 67.97 billion as of 14 December 2018 (14 December 2017: EUR 63.95 billion). At 86%, the lion's share came from international exchange members. On important international dates, such as the end of the quarter, the trading volume tripled. On the strongest trading day in 2018, 16 March, a volume of more than 1 billion EUR was traded. In 2018, Morgan Stanley accounted for 12.53% of stock exchange turnover in Vienna. The most active trading participants also include Merrill Lynch (8.22%), J.P. Morgan (7.84%), Société Générale (6.67%) and Raiffeisen Centrobank (6.21%). The buyers of Austrian shares are mainly large investors from the USA, Austria, Great Britain, Norway and France.

Over 670 new bond listings, one third of which are international

Stock market quotations are also an important quality criterion for the bond sector. As a premium marketplace, the Vienna Stock Exchange is recording an increased inflow of European bond issuers. As of 14 December, the Vienna Stock Exchange lists over 3,651 bonds, a new high (December 2017: 3,594). Of the more than 670 new listings, more than a third originated from international issuers.

Outlook 2019: Easy stock market entry for domestic SMEs and young companies

The Vienna Stock Exchange will launch a simplified market segmentation on 21 January 2019. The new segment "direct market plus" will be the new home for SMEs seeking a simple and quick initial public offering. Several Austrian companies are already working intensively towards ringing the opening bell next year. The experts within our "direct network" will be on hand to provide capital and advice.

Ludwig Nießen, COO & CTO says: "In 2019, Wiener Börse will complete the switch to one of the most modern trading systems available for all asset classes. Our infrastructure is appreciated for the seamless, stable operations and a strong European network of trading participants. Our longstanding product development experience is also paying off, as we've increased the number of customers and we've quadrupled the number of customers for our new TTRII reporting service."

The market capitalization of domestic companies listed on the Vienna Stock Exchange remained stable at EUR 107.31 billion as of 14 December 2018, above the EUR 100 billion mark. Trading will continue this year until 28 December, when an early closing auction at 14:15 will end the trading year.

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.