- Longest quotation list in the history of the Vienna Stock Exchange; record IPO was eighth-largest in the world

- All-time high in tradable securities and trades executed on the Vienna SE

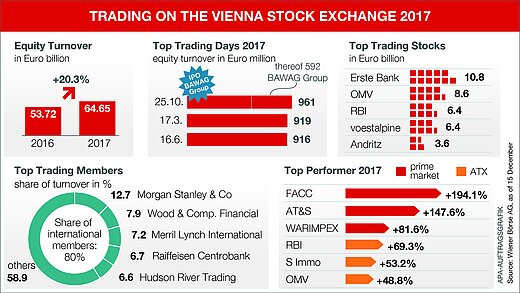

- Equity turnover increased by 20% yoy

- 80% of equity trading generated by international trading members

(Vienna) The Vienna Stock Exchange looks back on an excellent market performance in 2017, especially in terms of trading and initial public offerings. Equity trading volumes increased by 20% yoy, in contrast with trading volumes on major European markets, which moved mostly sideways. BAWAG Group AG was the eight-largest IPO worldwide and further boosted trading volumes. The leading Austrian index stood out as one of the leading indices worldwide at 25.24% (28.50% incl. dividends) from 1 January to 15 December 2017.

"We are pleased that our efforts have yielded fruit and we have managed to strengthen our position as the best trading venue for domestic stocks. We succeeded in convincing companies - and also market participants - of the excellent trading quality on our market: the narrowest trading spreads and internationally filled order books," explained Christoph Boschan, CEO of Wiener Börse AG. "Investment options on the domestic stock exchange for Austrian private investors have been expanded with the addition of international companies and by tapping into trends such as ETFs. Monthly trading volumes on the global market segment have doubled every month, which goes to show that we are on the right track."

Longest quotation list in the history of the Vienna Stock Exchange

The most notable developments this year included: Two IPOs on the regulated market of the Vienna Stock Exchange - BAWAG Group AG and Clean Energy AG, one SPO - Agrana AG, two capital increases - BUWOG AG and BTV AG. The newly founded segment global market now includes some 430 international securities, which is the widest range of equities that has ever been available for trading on the Vienna Stock Exchange.

As regards bonds, 2017 will break all records again. To date, 79 corporate bonds with a record volume of EUR 13.8 billion, were newly added to trading on the exchange. These include 19 corporate bonds of domestic issuers (EUR 2.65 billion) and 60 corporate bonds of foreign, above all, Italian issuers (EUR 11.23 billion). The number of international listings has doubled versus the previous year. Including banking and government bonds, the Vienna Stock Exchange now lists over 3,500 debt securities. Almost 1,000 bonds were newly listed this year. This all-time high was driven, on the one hand, by the MiFID II regulations, and on the other, by the service orientation of the Vienna Stock Exchange in the area of new listings.

Trading volumes: Top trading days and exchange members

On 15 December 2017, the trading volume totaled EUR 64.65 billion and was 20.3% higher year on year (EUR 53.72 billion) thanks to rising prices and lively trading by exchange members. The strongest trading day this year was 25 October, the first trading day of BAWAG Group AG, with a total volume of EUR 961 million whereof EUR 592 million were generated by BAWAG stocks alone. At 8.7 million executed exchange orders (projected figure until year-end: approximately 9 million), this marks the highest ever level of exchange trades executed over one year on the Vienna Stock Exchange. On average, monthly trading volumes reached EUR 5.6 billion until the end of November, the highest level since 2010.

Over 80% of equity trading is generated by international trading members. The highest share in trading volume (year-to-date, per 15 December 2017) was generated by Morgan Stanley & Co with around 12.68% ahead of Wood & Company Financial (7.91%) and Merrill Lynch International (7.18%). Raiffeisen Centrobank AG (6.66%) and Hudson River Trading (6.63%) came in fourth and fifth in the ranking. The most actively traded stock in 2017 was Erste Group Bank AG with a trading volume of EUR 10.77 billion, ahead of OMV AG with EUR 8.59 billion and Raiffeisen Bank International AG with EUR 6.44 billion.

"2017 was an intense year in which we reached five technical milestones. Never before have so many projects been implemented in one year. The Vienna Stock Exchange overhauled and modernized its trading platform and surveillance system, while at the same time implementing the new regulatory requirements of MiFID II. We also rolled out trading services for Zagreb Stock Exchange, as well as new reporting services," stressed COO/CTO Ludwig Nießen.

International leader ATX & Austria's top performers 2017

The leading index, the ATX, increased continuously over the course of the year from its all-year low on 2 January 2017 (2,654.94 points). The ATX reached its all-year-high on 2 November 2017 at 3,445.23 points. With a price gain of 69.30% since the start of the year, Raiffeisen Bank International AG is the best performing stock in the ATX, followed by S Immo AG with +53.15% and OMV AG with +48.84%. On the prime market, FACC AG (+194.13%), AT&S (+147.64%) and WARIMPEX Finanz- und Bet. AG (81.56%) were the top non-ATX performers. Market capitalization of domestic companies listed on the Vienna Stock Exchange amounted to EUR 121.09 billion on 15 December 2017, which is a gain of over 20% year on year (16 December 2016: 95.55 billion).

Outlook 2018

Once the implementation of MiFID II, capacities will have been completed, Vienna Stock Exchange’s resources will be freed up again for new projects. High trading quality for Austrian stocks will remain a central theme over the coming year. Work will continue on the further development of the international range of products for private investors.

"We will take measures to strengthen the marketplace in Vienna, especially as regards liquidity. We are concentrating first and foremost on talks with trading participants and investors and secondly on bolstering our digital presence. Our strategic plans to increase earnings and broaden the basis of our revenue streams are already showing results," said Christoph Boschan. "The recently presented government program is a silver lining. In particular, we are pleased about the plans to strengthen the second and third pillars of retirement provisioning, to open up the Third Market of the Vienna SE to SMEs, and to increase financial education. All these measures will provide the shot in the arm that the capital market needs to help finance Austria’s growth and increase its resilience to crises."

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.