- Lack of economic and financial knowledge is the biggest obstacle to equity investments

- Financially-educated Austrians invest in equities because of "higher returns", "money works for itself" and "pension provision"

- Tax incentives and better investment advisory would strengthen shareholder base in Austria

(Vienna) Austrians shy away from investing in securities when they feel too inexperienced in economic issues and are unable to assess the risk. Those who have a balanced knowledge of economics are more likely to resort to equities, funds and bonds. This is the core statement of a survey conducted by the research institute “market” on behalf of the Vienna Stock Exchange. The results reflect the attractiveness of various forms of savings and investments from the perspective of the Austrian population.

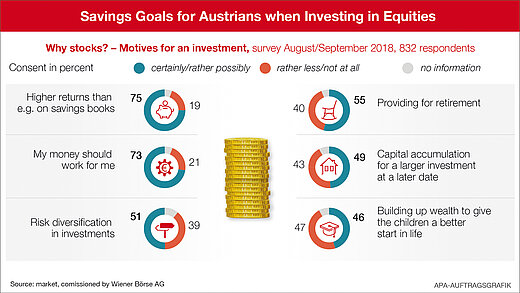

While 53% of those surveyed critically assessed their economic knowledge, 83% rated Austria as a very good or good business location. Traditionally, Austrians invest heavily in low-yield forms of investment such as savings books (72%) or building loan contracts (59%). According to IMAS, however, the actual shareholder ratio in Austria is only around 5%. This discrepancy clearly points to the lack of knowledge. For the respondents, the advantages of equities lie in the higher returns (75%), in having money work for themselves (73%) and in providing for retirement (55%).

The respondents decide against a stock-based financial product if they suspect that the risk is too high or feel a lack of information. The Austrian population would give greater consideration to equity investments if there were more tax incentives, better advice and stronger references to Austrian products. A reduction of the capital gains tax would massively increase the willingness to buy shares: 86% of respondents would invest "certainly" or "rather possibly" in securities. According to the survey, domestic shares and a stake in the employer would then be in particularly high demand. "Strengthening the domestic shareholder base would benefit both Austria as a financial centre and the leading Austrian companies. Currently, mainly international investors are investing in Austrian companies. That's a big compliment, but of course it also means exporting prosperity," says Christoph Boschan, CEO of the Vienna Stock Exchange, who presented the survey today together with researcher David Pfarrhofer in Vienna.

Real estate continues to be a popular form of investment. "An equity fund is much less work than the so called 'concrete gold', " says Boschan. "Stocks are easier to diversify and can also be acquired with a smaller budget. In addition, you can also set a real estate focus with equities and investment funds. One thing is clear: Investing is a marathon, not a sprint. The earlier you start investing, the more you profit. You can also participate with small amounts." A monthly amount of 50 euros, saved over 45 years in passive investment funds (ETFs) with a yield of 7% results in a total amount of around 200,000 euros (instead of 27,000 euros) due to the compound interest effect. For Boschan it is clear: "We must work more intensively on the financial education of young and old. As a stock exchange, we make a contribution here with 350 seminars a year, but the state would have to incorporate economic know-how more firmly in schools and also test the knowledge. People should not only participate in technological progress as consumers, but ideally also as shareholders of the companies that generate high profits."

Policymakers are also called upon to act when it comes to tax incentives - the equal treatment of capital gains or the reintroduction of the retention period would be the first steps here. "We need a strong business location in Austria. A vibrant financial market with a good equity culture strengthens Austrian companies as well as the wealth of the Austrians. That must be our common goal," concludes Christoph Boschan.

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.