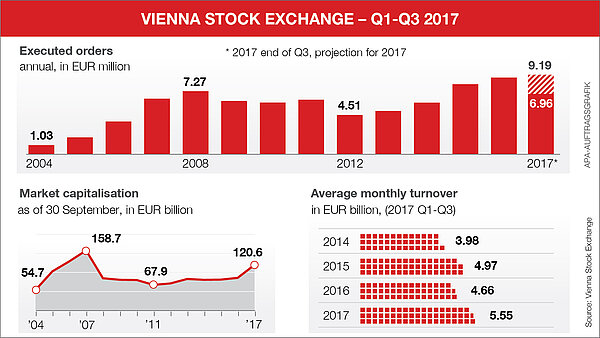

- Average monthly turnover hits highest level since 2010 at EUR 5.5 billion

- Market capitalization at highest level since 2008, 40% higher year on year

- Heading for a new record number of orders executed on stock exchange

(Vienna) The excellent development on the Vienna Stock Exchange continues. At the end of Q3 2017, the equity trading volume on the Vienna Stock Exchange totaled EUR 49.95 billion. This is a gain of 18.8% versus the same period of the preceding year (Jan-Sep. 2016: EUR 42.04 bn). Monthly average turnover in equities trading was EUR 5.55 billion for September, which is the highest level since 2010. The number of executed orders executed through the Vienna Stock Exchange heading for a new record: already in Q3 roughly 7 million orders were executed on the Vienna SE. (2016: 8.85 million, projection for 2017: 9.19 million).

"As a market leader for Austrian stocks, we are currently benefitting from the very positive overall market development. Secondly, we are seeing sustained high demand for Austrian shares. We offer investors the best prices in trading in domestic stocks and are working hard to make the advantages of our market known internationally," said Christoph Boschan, CEO of Wiener Börse AG. "Moreover, domestic investors have the benefit of being able to trade a growing range of international stocks on our global market segment launched in June 2017. We are working hard to expand the list of international stocks."

Longer quotation list

By including international shares and other securities in the segment <link 8160 - internal-link "Opens internal link in current window">global market</link>, we enlarged the quotation list of the Vienna SE by another 128 securities in Q3. In total, currently 429 international securities can be traded in the global market segment. Listing activity in corporate bonds continued at a brisk pace in the third quarter. By the end of September 2017, more corporate bonds were newly listed on the Vienna Stock Exchange than in the entire year 2016. In total, there were 49 new corporate bonds with a total outstanding volume of EUR 4.7 billion trading on the Vienna Stock Exchange of which 37 were international bonds (EUR 3.65 bn) and 12 bonds were issued by domestic companies (EUR 1.13 bn).

Trading system upgrade

The Vienna Stock Exchange is also ready for the future with its technical installations. In Q3, the new trading system Xetra® T7 was introduced for equity trading in Vienna. With the upgrade of the infrastructure, the Austrian stock exchange offers its national and international exchange members and listed companies a marketplace that is up to the latest standards. "Modern technology standards secure our position as market leader for trading in Austrian shares. Our new trading system is an important step in this direction, also with respect to infrastructure and security," explained Ludwig Nießen, COO & CTO of the Vienna Stock Exchange.

New Austrian Stock Exchange Act

An important step in legislation was also taken by policymakers. As of 3 January 2018, an amendment to the Austrian Stock Exchange Act will enter into force that enacts the requirements of MiFID II in national law. The new legal framework increases transparency and improves investor protection, especially regarding investment firms. A great improvement is the simplification of our the market structure by combining two regulated markets (Office Market and Second Regulated Market) into one market. In the future, all securities admitted to listing on the regulated market of the exchange will be traded on the "Official Market" (Amtlicher Handel).

Strengthening financial knowledge in Austria

The Vienna Stock Exchange demands that financial education be given more attention. The gaps in knowledge were revealed in a <link en/news/vienna-stock-exchange-news/news/financial-education-in-austria/>recent survey conducted on behalf of the Vienna Stock Exchange</link>. The majority of persons surveyed would like to have more economic and financial education in school for their children. The Vienna Stock Exchange offers further education in the form of 350 seminars per year, including custom-made offers for pupils and teachers. It also has a wide range of courses for private and professional investors at the Wiener Börse Akademie. The new program for 2018 went online in September. "Education is the key to raising awareness among Austrians of the opportunities, and also the risks, of the investment possibilities. We are seeing growing interest in our seminars. Also from professionals: The training course for exchange traders had to be enlarged to accommodate more attendees and cover demand. We hope that the theme of financial education will be taken seriously and that awareness will rise among politicians and in the population," said Boschan. "Then more people would be able to proactively manage their financial life and profit from the possibilities offered by the capital market."

Ranking in Q3 2017: Most frequently-traded stocks & trading members

The ranking of the stocks with the highest trading volumes in Q3 is lead by Erste Group Bank AG with a monetary turnover of EUR 2.39 billion ahead of OMV AG with EUR 1.85 billion and voestalpine AG with EUR 1.54 billion. Places four and five are taken by Raiffeisen Bank International AG (EUR 1.39 bn) and Andritz AG (EUR 1.02 bn).

Morgan Stanley & Co defended its position as the trading member with the highest turnover also in Q3 with 14.21% of turnover in equities and structured products on the Vienna Stock Exchange ahead of Merrill Lynch International (8.47%) and Raiffeisen Centrobank AG (6.63 %). Places four and five were taken by Erste Group Bank AG (6.36%) and Hudson River Trading (6.32%)

Ranking Q3 2017: Tops & Flops

In the course of the year, the Austrian leading index, ATX, gained + 26.64% (+ 29.75% incl. dividends) and reached 3,315.97 points on 29 September 2017. Thus, the Austrian price index is one of the global performance leaders. From an all-year low on 2 January 2017 (2,654.94 points), the leading index has risen continuously and reached an all-year high at the end of the quarter.

At a price increase of 63.15%, Raiffeisen International AG made the biggest price gains in the ATX, followed by S Immo AG with 49.75% and OMV AG with a gain of 46.87%. On the prime market, FACC AG (+ 141.68%), WARIMPEX Finanz- und Bet. AG (+ 98.70%) and Polytec Holding AG (+ 93.26%) ware the winners from among the non-ATX members. Market capitalization of domestic companies on the Vienna Stock Exchange was EUR 120.56 billion at the end of September, which is an increase of around 40% versus 30 September 2016 (EUR 86.47 billion).

Download info graphics

Current monthly statistics

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.