- Dividend kings: ATX companies pay 3.8% dividend yield

- 4 investment principles for private investors on the stock market

- Call for elimination of securities capital gains tax to reward long-term orientation

(Vienna) On 31 October 2019, World Savings Day – which launched in 1924 – will again be announced. The Austrian National Bank’s statistics show that with EUR 291 billion, a large part (40%) of Austria's private wealth is parked almost free of interest as bank deposits or cash. Thereby, the Austrian population accepts a large loss of purchasing power. In contrast, equity investments offer prospects of attractive returns: Since the Austrian national index ATX’ inception it has yielded an average annual return of 6.4%. High dividend payouts – Austrian stocks are among Europe's dividend kings – bring income and stability to the portfolio.

Christoph Boschan, CEO of the Vienna Stock Exchange, outlines how interested investors can approach the stock market: "On the journey from saver to investor, investors must consistently follow four signposts. Think of the long-term goal. Do not invest everything at once, but gradually enter and exit the market. Spread risk by not betting all your money on one horse. Only invest in products you understand or that can be explained to you. So don't wait for 'the hot tip'."

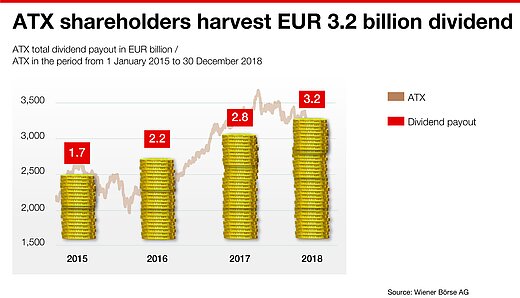

Austrian stocks are dividend kings

The dividend makes a decisive contribution to performance. Including dividends, the Austrian benchmark index has delivered a performance of +487.04% (ATX Total Return) since its inception; excluding dividends, the figure is +201.06% (ATX). Austrian companies are among the most attractive dividend payers in Europe. Never before have ATX companies distributed more profits in the form of dividends than in 2019. Their owners benefited from a total of EUR 3.2 billion for the past financial year. All 20 companies in the leading index paid out a dividend in the previous two years. With a dividend yield of 3.8%, the Austrian market ranks among the European leaders.

Compound interest makes all the difference

By committing to an investment strategy for decades, the exponential power of compound interest can unfold. "Whoever believes in progress and the further development of humankind should not only participate in economic life as a consumer, but also as an investor," Christoph Boschan pleads for people's attitude towards stocks and calculates: "Assuming a monthly savings rate of 100 euros, 60.000 euros could become 440.000 euros over a working life of 50 years, assuming the historical yield in the leading Austrian index. The experience people have on their savings accounts will pale in comparison. It's time to replace the World Savings Day with a World Investment Day."

Political empowerment for individual participation in economic life

Lack of knowledge about financial instruments are currently preventing many Austrians from benefiting from capital market returns. "Ideologically neutral financial education must become the focus of the next government's efforts. Education is the best investor protection and pays off," Christoph Boschan is convinced, "there is an urgent need for tax incentives as well. The population perceives it as double taxation when they invest from their earned income, provide for their old age and are punished by a higher tax."

The ownership of shares in Austria is currently taxed at 27.5%, savings deposits at 25%. If gold is held for more than one year and a profit is made, it is tax-free. The Vienna Stock Exchange is committed to the equal treatment of capital gains, above all the reintroduction of the exemption from capital gains tax on securities with a retention period of one year. Thereby, long-term equity investments are promoted. "This would encourage calm hands in the market and reward long-term orientation. A clear distinction must be made between short-term speculation and long-term investment in the domestic real economy," says Boschan.

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.