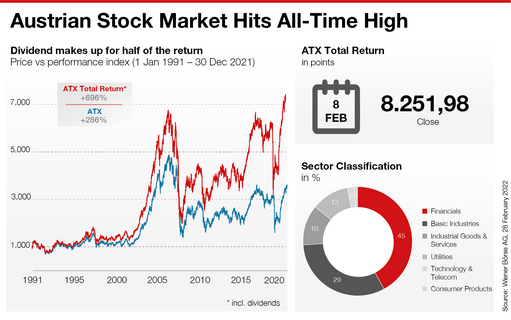

- ATX Total Return (incl. dividends) reaches its all-time high

- Equity turnover in HY1 2021 stable at previous year's level (EUR 39 billion)

- Three new entries in direct market plus (SME segment)

- Record level of new bond listings

(Vienna) In the 250th anniversary year of the Vienna Stock Exchange, the Austrian stock market benefits from the economic upswing. Including dividends, the ATX national index reached its all-time high. In the first half of 2021, the ATX outperformed all developed markets. This boosted trading volumes on the Vienna Stock Exchange. Meanwhile, the entry segment of the Vienna Stock Exchange received three new entries: beaconsmind AG, Biogena Group Invest AG and XB Systems AG rang in their first day of trading. With 3,217 bonds, the number of new bonds as of 30 June 2021 already exceeded that of the entire year 2020.

"The Vienna Stock Exchange scores with its infrastructure, international network and service quality among its customers. In the bond segment, we established ourselves as a major player in Europe. More companies using the Austrian stock exchange will be crucial for future growth in Austria. The reintroduction of the retention period is an important step towards building a broader shareholder base in Austria," said Christoph Boschan, CEO of Wiener Börse AG.

Average monthly turnover at 10-year high

From January to June 2021, trading participants on the Vienna Stock Exchange generated an equity turnover of EUR 38.90 billion. This is almost as much as in the volatile first half of 2020 (EUR 39.18 billion). With a monthly turnover of at least EUR 6 billion, the trading volume remained consistently high (average monthly turnover: EUR 6.5 billion). International trading members account for 83.3% of exchange turnover. The expiry dates were the strongest trading days as usual: March 19 (EUR 1.27 billion), April 16 (EUR 899 million), June 18 (742 million). The most actively traded Austrian stocks in the first half of the year were OMV AG (EUR 5.82 billion), Erste Group Bank AG (EUR 5.68 billion), Verbund AG (EUR 4.54 billion), voestalpine AG (EUR 3.00 billion) and Raiffeisen Bank International AG (EUR 2.21 billion). The turnover contribution of international equities (global market) increased by 52% year-on-year from EUR 1.73 billion (HY1 2020) to EUR 2.62 billion (HY1 2021).

ATX celebrates its 30th anniversary with an all-time high

The ATX Total Return (incl. dividends) increased by 24.54% in the first half of the year and stopped at 6,807.92 points on 30 June 2021 (ATX excl. dividends: 3,402.02 points, +22.36%). With this development, the Austrian national index is the top performing index year-to-date (CAC 40 +16.22%, S&P 500 +15.15%, EUROSTOXX +13.80%, DAX +13.21%, FTSE 100 +7.35%). The ATX Total Return reached its annual high and at the same time also its all-time high on 15 June 2021 with 7,123.49 points (intraday), respectively on 14 June 2021 with 7,109.60 points on closing price basis. All 20 ATX stocks posted gains for the half-year. The top-performing ATX stocks are Österreichische Post AG (+56.27%), OMV AG (+45.36%) and AT&S Austria Technologie & Systemtechnik AG (+39.85%). In the prime market, Addiko Bank AG (+60.00%), Polytec Holding AG (+55.79%) and Frequentis AG (+49.17%) posted the highest gains. The market capitalization of domestic companies listed in Vienna rises to EUR 129.14 billion as of 30 June 2021.

250 Years of the Vienna Stock Exchange - Looking ahead to the next 250 years

On 2 September 2021, the Vienna Stock Exchange will celebrate its 250th anniversary. To mark this occasion, the Vienna Stock Exchange regular hosts discussion rounds this year. Experts, historians, entrepreneurs, and scientists talk about past and future developments on the stock market. Watch our videos on youngest and oldest listed companies, on financing the industry of the future or on the way from Vienna's floor to the electronic trading network.

Download infographics:

Strong first half of 2021 (png-file 130 KB)

ATX hits all-time high (png-file 165 KB)

About the Vienna Stock Exchange

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.