(Vienna) The Vienna Stock Exchange is further expanding its range of titles in the international market segment global market and Exchange Traded Funds (ETFs) with a focus on ESG and digitalisation. A total of ten new shares – primarily from the USA – and seven additional ETFs will be offered.

"With these new additions, we are offering investors the opportunity to invest in current and relevant topics on the Vienna Stock Exchange and benefit from favourable conditions at the same time. Our global market segment makes international capital markets accessible without foreign fees," says Manuel Kurz, Deputy Head of Member Sales & Business Development.

New US blue chips from the digitalisation sector

With the cloud-based company "Zscaler", the software developer "Splunk” and the semiconductor manufacturer "ON Semiconductor", the global market has gained significant growth from the digitalisation sector. Other notable new additions include the American Depository Receipts of the pharmaceutical company "AstraZeneca" and the media group "Warner Bros. Discovery", whose portfolio includes the news channel "CNN" and the comic publisher "DC". In addition to US blue chips, the Dutch distributors of e-charging stations and energy solution providers "Fastned” and "Alfen" are also newly listed in the international segment of the Vienna Stock Exchange.

Paris Agreement on climate change plays a major role in new ETFs

There is a clear focus on sustainability in the newly tradable ETFs – passive funds that track the performance of a stock market index as closely as possible. In addition to the Amundi MSCI Global Climate Change UCITS ETF, ETFs with EU Paris-aligned Benchmarks (PAB) will be included in trading on the Vienna Stock Exchange, which exclusively comprise companies whose CO2 emission volumes comply with the Paris Agreement on climate change. These include the UBS MSCI Japan Climate Paris Aligned UCITS ETF and the BNP Paribas Easy Low Carbon 100 Europe PAB UCITS ETF.

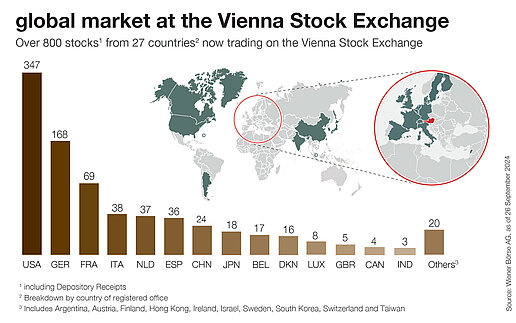

"These expansions emphasise the Vienna Stock Exchange's commitment to offering its investors a diverse and up-to-date portfolio," says Manuel Kurz. The global market now comprises around 800 securities from 26 countries, which can be traded at domestic fees, while a total of 139 ETFs are listed on the Vienna trading venue. As a market maker, Lang & Schwarz guarantees attractive prices and liquidity on both sides.

Download:

List of securities (pdf-file 50 KB)

Infographic global market (jpg-file 350 KB)

About the Vienna Stock Exchange

As the central infrastructure provider in the region, Wiener Börse AG opens doors to global markets. It unites the stock exchanges in Vienna and Prague. Listed companies benefit from maximum liquidity there, and as the market leader it offers investors fast and inexpensive trading. Wiener Börse collects and distributes price data and calculates the most important indices for a dozen markets in the region. Thanks to its unique know-how, the national exchanges in Budapest, Ljubljana and Zagreb also rely on the IT services of the Vienna Stock Exchange. In addition, it is involved in other energy exchanges and clearing houses in the region.

Disclaimer

This press release may contain certain forward-looking statements and projections based on assumptions current at the date of this press release. We assume no liability whatsoever that these forward-looking statements will occur. Furthermore, we expressly point out that this press release does not serve as a basis for an investment decision and constitutes neither an invitation to buy nor an investment recommendation by Wiener Börse AG. The information in this press release is provided without guarantee.