- Equity turnover on the Vienna Stock Exchange almost doubled since 2012

- global market segment further expanded to cover Asian blue chips

- Vienna becoming European bond listing hub; international issues, green & social bonds are a trend

- International members account for 85 % of VSE's turnover

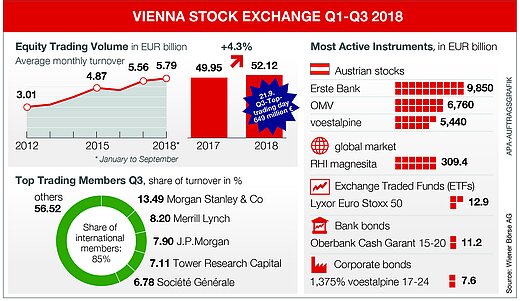

(Vienna) Equity turnover on the Vienna Stock Exchange increased significantly despite sideways movement in the leading Austrian index ATX, and almost doubled since 2012. The trading volume in Q3 2018 amounted to EUR 15.06 billion, up 5.9% on the previous year (Q3 2017: EUR 14.23 billion). In a year-on-year comparison, total trading turnover was up 4.3% (Q1-3 2017: EUR 49.95 billion, Q1-3 2018: EUR 52.12 billion). Share turnover has almost doubled since 2012. The average monthly turnover at the end of September was EUR 5.79 billion. The Austrian stocks with the highest turnover were Erste Group Bank AG with EUR 9.85 billion, followed by OMV AG with EUR 6.76 billion and voestalpine AG with EUR 5.44 billion. Raiffeisen Bank International AG (EUR 5.29 billion) and Andritz AG (EUR 3.01 billion) ranked fourth and fifth respectively.

"The turnover developments show that we are the clear market leader when it comes to trading in Austrian equities. Our partners appreciate the execution quality and state-of-the-art technology of the Vienna Stock Exchange, as well as the cost-effectiveness we offer. For Austrian investors we are continuously expanding our international offering, most recently with a new Asia orientation in our global market segment," says Christoph Boschan, CEO of Wiener Börse and its holding company.

Ludwig Nießen, COO & CTO of the Vienna Stock Exchange, adds: "The maximum system availability, meticulous attention paid to cyber security and continuous optimization of our IT systems secure our position as market leader for Austrian equities. In the run-up to Brexit, the trading members affected by it are also offered intensive on-site support."

global market segment further expanded to cover Asian blue chips

With 33 new Asian blue chips, the Vienna Stock Exchange currently offers Austrian investors around 570 securities from 24 countries in the <link 8173 - internal-link "Opens internal link in current window">global market</link> segment. Turnover is rising steadily, making the international segment the second strongest stock market segment after the dominant <link 726 - internal-link "Opens internal link in current window">prime market</link>. A total of 762 equity securities (e.g. shares or ETFs) are currently tradable in Vienna, more than ever before. RHI Magnesita N.V. was the most traded share in the global market with EUR 309.36 million. In the ETF segment, the LYXOR ETF EURO STOXX 50 (EUR 12.86 million) was the highest-turnover security.

Vienna becoming European bond listing hub; international issues, green & social bonds are a trend

The Vienna Stock Exchange is increasingly developing into a European bond listing hub. A total of 261 corporate bonds with a volume of EUR 41.4 billion are tradable on the Vienna Stock Exchange, the majority of which are international bonds. Around 2,400 bonds from the financial sector are tradable in Vienna, and the proportion of international issuers is increasing. Green and social bonds are a strong trend for new issues. With BKS Bank and WEB Windenergie, the volume of listed green and social bonds increased to EUR 1.62 billion. The 1.375% voestalpine bond with a term of 2017-2024 was the most frequently traded corporate bond (EUR 7.61 million).

International members account for 85% of VSE's turnover

In addition to the two major Austrian trading participants, international exchange members accounted for around 85% of turnover on the Vienna Stock Exchange. In the third quarter, Morgan Stanley was the top trading participant with a 13.49% share of turnover, ahead of Merrill Lynch (8.20%) and J.P. Morgan (7.90%). Fourth and fifth place followed Tower Research Capital (7.11%) and Société Générale (6.78%).

Statistics: ATX in European sideways concert

At the end of the third quarter, the ATX stood at 3,344.04 points (annual high on 23 January 2018: 3,688.78 points, annual low on 3 July 2018: 3,224.40 points). The sideways movement of the ATX benchmark index as at 28 September 2018 resulted in a minus of 2.33%, showing slight plus of 0.55% including dividends. This puts Austria's leading index at the upper end of the range of established European indices. The market capitalization of all domestic companies listed on the Vienna Stock Exchange was EUR 127.8 billion as of 28 September 2018.

Details on the individual market segments, indices and securities are available on our web statistics page. A comparison of European stock exchanges is available in the statistics published by the Federation of European Securities Exchanges (FESE).

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.