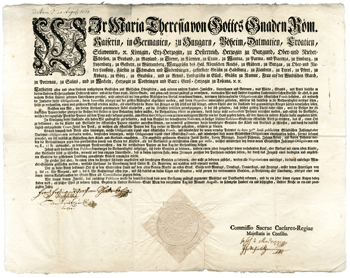

The first efforts to establish a stock exchange were made as early as 1761. It took until 1771, when Empress Maria Theresa founded the Vienna Stock Exchange as a stock exchange for the purpose of raising capital for the state. It followed the French model and was under government control. Only bonds, bills of exchange and foreign currencies were permitted to be traded. Stockbrokers, called 'Sensale' on the Vienna Stock Exchange, ensured smooth trading and received a commission for brokering the transactions. At the time, trading on Vienna Stock Exchange was conducted in person and not electronically as today. As the central market, the stock exchange guaranteed not only official price determination, but also speed and security in the settlement of transactions.

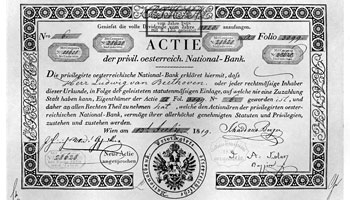

After the Austrian state went bankrupt in 1811, the Austrian central bank was founded in 1816. It was granted the monopoly for the issuance of banknotes, and this brought calm to the Austrian monetary system. In 1818, the Austrian central bank was the first joint-stock company to be listed on the Vienna Stock Exchange. One of the first shareholders was Ludwig van Beethoven who bought eight shares in the Austrian central bank in 1819. In the middle of the 19th century, the Vienna Stock Exchange gained international renown due to the political and economic significance of the Habsburg Empire at the time. This period saw a surge in new companies, especially in the industries of transport, railways and steamships. Shares in Emperor Ferdinand's Northern Railway were first listed on the stock exchange on 3 May 1842, followed by shares in the Budweis-Linz-Gmundner Railway (10 June 1842) and the Vienna-Gloggnitz Railway (1 May 1843).

On 1 January 1855, an Imperial Decree establishing the new stock exchange legislation came into force which was an important step away from state control of the exchange towards autonomy. The state largely gave up its paternalism over the stock exchange and regulated only the legal framework. A newly created Stock Exchange Chamber took over the administrative and judicial functions. It consisted of 18 members. Apart from the still important segment of government bonds, securities issued by private companies started to gain significance. The new securities included shares issued by banks such as the Credit-Anstalt für Handel und Gewerbe. Joint-stock banks took over some of the functions previously reserved for private bankers and engaged in the custody business as well as in long-term financing, securities issuance and securities trading. For the economy of the Austro-Hungarian Empire, the listing and tradability of an increasing number of securities on the stock exchange opened up access to foreign investors.

During the period of economic expansion, which was to last until 1872, the Vienna Stock Exchange saw numerous new issues, especially of banking, railway and industrial shares. Shortly after the foundation of "Allgemeine Österreichische Baugesellschaft", investors were for the first time able to trade shares of today's PORR AG on the Vienna Stock Exchange. Just one week later, another domestic flagship company, Wienerberger AG, joined the stock exchange. At over 150 years of listing, the two stock corporations are today's oldest shares on the Vienna Stock Exchange.

In 1863, the 'Suez Canal Company' was the first foreign company to be listed on the Vienna Stock Exchange. Austria had a special interest in the construction of this navigation channel in Egypt, as it significantly enhanced the position of Trieste as a conveniently located port for Central European trade with Asia. In 1865, there was a further foreign listing with the premium bonds issued to fund Turkish railway lines ('Türkenlose'). When the Frankfurter Bankverein applied for a listing of these bonds on the Vienna Stock Exchange, the Exchange Chamber decided to introduce rules for the admission of foreign securities. In 1873, the "Italian bond" ("Italienische Rente") was the first official foreign listing by means of a formal application. Today, about 800 securities from 26 countries are available to Austrian investors in the global market segment. The global market segment includes international securities that are listed on at least one further stock exchange.

From 1867 to 1873, the Austro-Hungarian Empire saw the rapid rise of industrialization and economic growth. Many companies raised funding on the stock market by issuing shares, and this trend gave the era its German name 'Gründerzeit'. However, liberal economic policy also encouraged unsound companies and the tidal wave of speculation ended with a crash on 9 May 1873 - the Vienna stock market crash. About half of the listed stock corporations disappeared from trading. It took years for the Vienna stock exchange to recover from this setback. This situation revealed the need for a new legal framework, which was created with the Stock Exchange Act of 1 April 1875. The Vienna Stock Exchange Act introduced one of the first modern stock market legislations in Europe in the 19th century and, with few changes, governed the stock exchange in Austria until 1989. The 114-year-old law was replaced by the Stock Exchange Act of 1989. With the implementation of the European MiFID II Markets in Financial Instruments Directive, the Stock Exchange Act was amended again in 2018 and this version is in force today.

In 1771, the year of its foundation, the stock exchange was located at Kohlmarkt 12 (now Kohlmarkt 16). In the 19th century, the Vienna Stock Exchange was located in "Palais Dietrichstein" at Minoritenplatz 3 and in "Palais Ferstel" at Herrengasse 14, where Café Central is today. The historic stock exchange building on Schottenring designed by Theophil von Hansen was inaugurated in 1877.

With the outbreak of the First World War, the Vienna Stock Exchange closed between July 1914 and December 1919. As a result, stock exchange trading shifted to the surrounding streets and cafés. This also happened in March 1938 with the Anschluss (political union) of Austria with the German Reich. By April of the same year, all Jewish-owned banks had been placed under the provisional administration of Giro- und Cassenverein. In July 1938, stock exchange laws were changed and Jews were no longer admitted to the stock exchange. Jewish heads of companies regularly took part in stock exchange sessions the time. Jews were arrested, their assets blocked (expropriated) and entrusted to provisional managers, making it impossible to move Jewish assets abroad. The Vienna Stock Exchange lost its independence during the years of the Second World War and was subject to German stock exchange law. The Official Market of the Vienna Stock Exchange resumed trading in November 1948.

In July 1949, the first government bond of the Second Republic, the "Aufbauanleihe" (reconstruction bond), was issued and listed on the stock exchange. The stock market suffered certain constraints after the war due to the nationalization of certain branches of industry. The bond market, on the other hand, recovered after the currency reform in 1952.

On 13 April 1956, a major fire destroyed the historic stock exchange building and one of the most beautiful stock exchange trading floors. Other significant parts of the building and the façade remained almost intact. The stock exchange building was reopened in December 1959. In January 1998, the Vienna Stock Exchange moved from the historic stock exchange building on Schottenring to the premises of Oesterreichische Kontrollbank (OeKB) at Strauchgasse 1-3 and Wallnerstrasse. The last change of location took place in 2002 when the Vienna Stock Exchange moved completely to Palais Caprara-Geymüller at Wallnerstrasse 8, where the headquarters of the Vienna Stock Exchange are located today.

In 1968, the WBI (Wiener Börse Index) was the first index to be created by the Vienna Stock Exchange. The WBI contains all Austrian shares listed on the regulated market of the Vienna Stock Exchange and as an overall market index, it tracks the development of the domestic capital market. The WBI is still being calculated today.

In 1985, the American analyst Jim Rogers pointed out the high potential of the Austrian capital market, triggering a stock market boom. In this period, the cautious attitude of politicians towards the stock market also changed. The privatizations of 1987 saw many prominent Austrian companies go public. Among them were OMV (1987), Austrian Airlines, Verbund (1988) and EVN (1989).

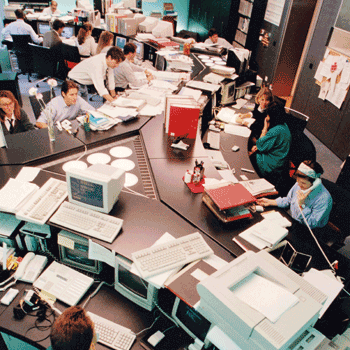

In 1989, stock trading on the Vienna Stock Exchange was still only partially automated, initially through PATS (Partly Assisted Trading System), the system run by Oesterreichische Kontrollbank. In 1996, the cash market on the Vienna Stock Exchange was gradually changed over to the fully automated trading system EQOS (Electronic Quote and Order-driven System). In 1999, EQOS was replaced by XETRA (Exchange Electronic Trading System), the trading system developed by Deutsche Börse AG. This marked the start of technology cooperation with Deutsche Börse, which continues to this day. In the period until 2012, the Vienna Stock Exchange also implemented the trading system at its later partner exchanges. Since 31 July 2017, the successor system T7 of Deutsche Börse has been in operation.

In 1991, the ATX (Austrian Traded Index) was published for the first time and today, it is still the leading index of the Vienna Stock Exchange. It is a real-time calculated price index developed by the Vienna Stock Exchange that covers the blue chip segment of the Austrian stock market and contains the 20 most liquid shares of the Vienna Stock Exchange. The shares are weighted according to their free float capitalization. The development of the ATX companies, including dividends, is reflected by the ATX Total Return Index (ATX TR). This is a performance index – like the German benchmark index DAX. In 2020, the Vienna Stock Exchange calculated some 150 tradable indices for countries, sectors, regions and various investment themes and styles. The focus is on Austria, CEE and Russia. These indices are used by more than 140 financial institutions worldwide as an underlying for their products.

In December 1997, the Vienna Stock Exchange Chamber was merged with the Austrian Futures and Options Exchange (ÖTOB) to form the new exchange operating company, Wiener Börse AG. Over the following years, the business spectrum of the Vienna Stock Exchange was gradually broadened. Starting out from the main revenue stream of trading and listing of financial instruments, it was widened to include market data dissemination and index calculation as well as IT services and central securities depository services. Today, the Vienna Stock Exchange has four sources of revenue and is a market-oriented company owned by Austrian banking institutions and listed companies.

In 1999, the Austrian Takeover Commission was created to provide an exit mechanism for the remaining shareholders in the event of a change of control of a listed company. It is responsible for the enforcement of the Takeover Act, which was modelled on international standards and aims to increase the attractiveness of the stock exchange for free float shareholders. Since 1999, the Takeover Commission has handled 87 takeover procedures.

At the beginning of 2002, the prime market segment was launched. Companies listed on the prime market must fulfil the admission criteria of the Stock Exchange Act as well as additional stringent transparency, quality and disclosure criteria. In March 2002, the Austrian electricity exchange EXAA (Energy Exchange Austria) started operation. The Vienna Stock Exchange’s investment in EXAA contributed significantly to the creation of a platform for trading in energy products. Further investments followed in subsequent years. These include a 20 percent stake in Central European Gas Hub AG (CEGH) in 2010. This cooperation strengthened Austria as a gas trading hub and helped CEGH become the most important gas hub on continental Europe.

On 1 April 2002, the Financial Market Authority (FMA) started work as an independent supervisory authority under the Financial Market Authority Act (FMABG). It was entrusted with the supervision of banks, insurance companies, pension funds and the entire securities sector. The FMA also represents the interests of the domestic financial market on numerous international bodies – especially within Europe.

CCP Austria Abwicklungsstelle für Börsengeschäfte GmbH was founded by the Vienna Stock Exchange and Oesterreichische Kontrollbank (OeKB) as a central counterparty on 2 August 2004. Since January 2005, CCP.A has been the clearing and settlement agent for all exchange transactions on the cash and derivatives market of the Vienna Stock Exchange. The clearing agent, which acts as an intermediary between buyer and seller, reduces securities settlement and risk costs, and facilitates market access for new market participants. Today, Wiener Börse AG holds a 50% stake in CCP.A.

The Vienna Stock Exchange began building its network in Central and Eastern Europe in 2004 based on cooperation agreements. The first step was the acquisition of a majority stake in the Budapest Stock Exchange. This was followed by the acquisition of majority stakes in the Ljubljana and Prague stock exchanges. These holdings were merged into the stock exchange holding company CEESEG AG in 2009. During this period, the cooperation network consolidated the role of the Vienna Stock Exchange as an infrastructure provider for price data dissemination and index calculation in CEE and CIS. In 2015, the stakes in the Budapest Stock Exchange and Ljubljana Stock Exchange were sold again. The Vienna Stock Exchange continued to focus on cooperation agreements and cultivated partnerships as a service provider. In the spring of 2020, the exchange operating company, Wiener Börse AG was merged with the former Group holding company CEESEG AG; the Prague Stock Exchange is now a 99.54% subsidiary of Wiener Börse AG. Cooperation agreements in the CEE and CIS region are in place today with the stock exchanges of Banja Luka, Belgrade, Budapest, Bucharest, Istanbul, Ljubljana, Podgorica, Sarajevo, Skopje, Sofia, Zagreb as well as with the Ukrainian State Agency, Ukrainian National Depository and the PFTS exchange in Kiev. Outside of Europe, the Vienna Stock Exchange cooperates with Kazakhstan SE. As an infrastructure provider, the Vienna Stock Exchange supplies the markets of Croatia, Austria, Slovenia, Czech Republic and Hungary with the trading system and supplementary IT services.

Today, the Vienna Stock Exchange is the clear market leader in trading in Austrian equities and is known for its international network of trading participants, investors and data vendors. As the heartbeat of the Austrian capital market, our stock exchange is the most important provider of market infrastructure in the region and builds bridges for companies to the world's most important financial centers, opening the way for investors to the growth region of Central and Eastern Europe. As operator of exchange infrastructure, it is our task to ensure transparent and smooth trading, especially when times get turbulent, and to ensure that investors can sell or buy securities at any time.